As with all ratios, this ratio should also be used while comparing companies across similar industries. Then, we calculate the Asset Turnover Ratio Using FormulaĪsset turnover ratio is an efficiency ratio that measures how a company effectively uses its assets to generate sales. You can easily calculate the Asset Turnover Ratio using Formula in the template provided. You can use the following Asset Turnover Ratio Calculator

The asset turnover ratio may in any given period be lower due to a purchase of assets. It is plausible that a company asset turnover ratio for any given year might be higher due to various factors such as selling off assets etc. It is pointless to compare the asset turnover ratios between a telecommunications company and an IT service company.Īlso, another point to be remembered is that it is not sufficient to just compare asset turnover ratios of companies for a single year or couple of years. Hence the comparison of asset turnover ratios between companies is more substantial when it is done between companies that operate in similar industries. the asset turnover ratios will be lower since their assets will be much higher. Similarly, for highly capital-intensive industries such as petrochemicals, utilities, power, etc. Significance and UsesĪs expected, low margin companies would have higher asset turnover ratios since they have to offset lower profits with higher sales. Hence while comparing asset turnover ratios for companies operating in the same industry this should be one of the factors that need to be taken into consideration. Some of the reasons are poor inventory management and collection methods or due to excess production capacity.Īlso, another factor to be considered is for companies operating in the same industry, sometimes a company with older assets will have higher asset turnover ratios since the accumulated depreciation would be more. There are various reasons for which the asset turnover ratio may be lower for a company. Conversely, if the ratio is lower it indicates that the company is not using its assets efficiently. Hence a higher ratio for asset turnover is a good sign that the company is using its assets efficiently.

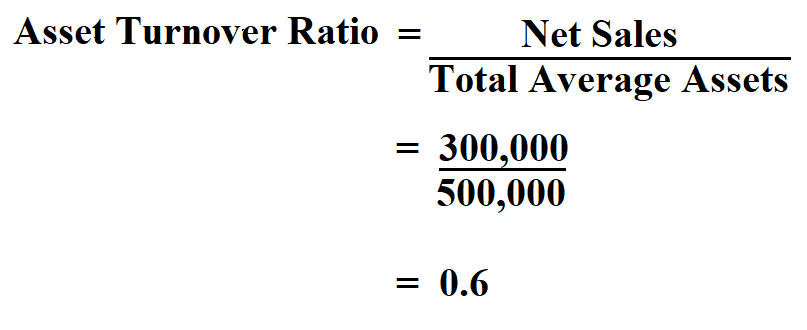

The DuPont Analysis calculates the Return on Equity of a firm and uses profit margin, asset turnover ratio, and financial leverage to calculate RoE. Asset Turnover Ratio Formula – Example #3Īsset Turnover Ratio is used in multiple ways, one of which is its usage is DuPont Analysis. IOCL has the lowest asset turnover ratio of the three companies but at least it is greater than 1 which is a good sign. Companyįrom the above table, one can see that BPCL has the highest asset turnover ratio of 2.87 which means for every 1 rupee invested in assets 2.87 rupees sales are generated. We take the example of Indian Petrochemical companies Indian Oil Corporation (IOCL), Hindustan Petrochemicals (HPCL), and Bharat Petroleum (BPCL). Let us take a practical example of companies operating in the petrochemicals industry for whom asset turnover ratio is important as they have to invest a large amount in capital expenditure. Asset Turnover Ratio Formula – Example #2 This indicates that for company X, every dollar invested in assets generates $4 in sales. Asset Turnover Ratio = Net Sales / Average Total Assets.Total Assets for the year 2019 = $30000.Total Assets for the year 2018 = $20000.

#TOTAL ASSET TURNOVER RATIO FORMULA DOWNLOAD#

You can download this Asset Turnover Ratio Formula Excel Template here – Asset Turnover Ratio Formula Excel Template Asset Turnover Ratio Formula – Example #1

0 kommentar(er)

0 kommentar(er)